In her new book, South Korean Civil Movement Organisations: Hope, Crisis and Pragmatism in Democratic Transition, Amy Levine shows us how a commitment to American pragmatism crosses disciplinary and academic boundaries. On different occasions, references to pragmatism abound in legal scholarship and legal practice, underpin concerns about what anthropology does (e.g. Rabinow, 2008), but have also become increasingly common among social scientists (e.g. Miettinen, 2006: Miettinen et al., 2012; Watson et al., 2012) who engage in Science and Technology Studies (STS), which means the philosophical, sociological, and anthropological inquiry of science and technology. Illustrating this, Levine selects one of the better-known members of this school, French philosopher, anthropologist, and sociologist of science Bruno Latour, mainly associated with a research line named Actor-Network Theory (Latour, 2005). Her discussion breaks down how pragmatism runs through the work of Latour – an indebtedness confirmed not only by Levine, but also by Latour’s own more recent writings (e.g. Latour, 1999, 2005, 2007) as demonstrated by her book.

Relevant, vested in empirical examples, and well-known as Latour’s commitments are, Levine chooses wisely to pinpoint his work specifically in the book.

This blog post explores this topic in relation to another known and policy-related area of STS: broadly, the sociology of markets, sociology of finance, social studies of markets, or named in other related terms. This research area includes economics, economies, finance, and markets from a social science point of view, but rather differently than is usually the case. In particular, instead of developing a critique of economic theory by using social science theories and methods (e.g. Miller, 2002), the focus is on the specific and concrete relationships between economics and economic practices – especially on how the former, in the most general sense, can reshape the latter in different situations (Callon, 1998).

An oft-cited research concept in these discussions summarises it by arguing that economics is performative (MacKenzie, 2003, 2007). This means that as economics – in the academic sense (e.g. economic theory) and the non-academic sense (e.g. marketing, economic engineering) – observes, measures, predicts, theorises, regulates, and experiments with the world – for example, as economists consult firms and governments, invent new tools, or create economic institutions (MacKenzie et al., 2007: 6) – the practices that these interventions target may start to resemble economic theory more than they did before.

Such a performativity does not need to move linearly nor predictably from economic theorising to its diffusion in the world (Callon, 2007). Nor does performativity always imply successful adoption of economics. Rather, if economics reshaped practices as was anticipated, it was effectively performative, but if it had unwanted counter-effects, then economics was counter-performative (MacKenzie, 2007) – as financial crises now and before attest (see MacKenzie & Spears, 2014). Nevertheless, the notion of performativity helps point out the multiple different contributions that economics has to the economy, being almost always present in understanding technology, change, and society at large (Callon, 2007: 313). Unmistakably, then, these research lines are drawing from an interest in pragmatic issues. The research questions themselves indicate it.

It is a pragmatic problem to explore how economics may alter the world – markets, technology, innovations, or other things – and what practical effects it causes in so doing – to human actors, firms acting on markets, governments, and so forth.

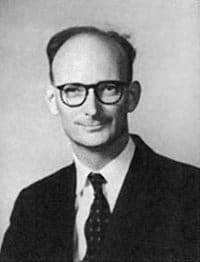

The research terminology also suggests a pragmatist legacy. The concept of performativity diffused, most likely, to the sociology of markets from the Edinburgh-based sociology of knowledge and its performative theory of social institutions (after sociologist Barry Barnes, e.g. Barnes 1983; social scientist Donald MacKenzie, among the best-known sociologists of markets, is based in this same school and names one of his performativity concepts Barnesian in MacKenzie, 2007). Their key argument is that social concepts, or institutions, including authority, marriage, money, and so forth, are self-validating and self-referential. Rather than referring to objects whose qualities are independent of observation, the application of social concepts generates those things that they reference (Schyfter, 2009: 37-39), which is particularly apt for financial theories and terminologies according to MacKenzie (2001).

But as Barnes (1983) acknowledges, the term itself was invented by J. L. Austin (1962), a linguistic philosopher and a typical reference point also for market sociologists (e.g. MacKenzie, 2001, 2007; Callon, 2007). Austin’s research is commonly situated in the study of the pragmatics of language. This is because he discussed the distinctively pragmatic, both intended and unintended effects of sentences such as declarations, wills, bets, and promises (see e.g. Abrams & Lieu, 2011; Faulkner, 2012). In particular, if stated by appropriate persons in the right circumstances (Austin, 1962: 14-15), these sentences become performative in that they do not merely describe actions, but rather produce actions, or a part of them.

In a similar vein, it might be said that economics does not merely describe the economy and activities of markets, but is part of the making of the economy and the markets, again in the most general sense (Callon, 1998). By using the concept of performativity, the pragmatic disposition of Austin seems to be inherited by the sociology of markets and its attention to how economics interacts with economic activities.

However, the issue of a pragmatist legacy and its acknowledgement by market sociologists no longer warrants speculation. In a recent volume, MacKenzie and his colleagues (2007: 3) make the connection explicit. In effect, a pragmatist tradition underpinned their work, through the notion of performativity:

“(T)he notion (of performativity) partakes of a long pragmatist tradition (nourished by the work of authors such as Charles S. Peirce, William James, John Dewey, Charles W. Morris, and more recently, John R. Searle) for which a central issue is the way in which actions, entities, and representations are intertwined. Performativity is not achieved by words alone. … (T)he “conditions of felicity” that make an utterance successfully performative are social as well as linguistic and bodily(.)”

Intriguingly, while Austin was the linguist that carried forth pragmatics to the sociology of markets, the above also distances itself from a presumed preoccupation with language by adding social and bodily elements to the inquiry. I will discuss how such analytic separations work in the context of the performativity programme below. An important explanation, which the authors in this field associate with philosopher Michel Callon (2007) is to do with knowledge: “Instead of regarding statements as true or false, pragmatism conceptualises them as successful or failed.” (MacKenzie et al., 2007: 14.) The idea of studying economic knowledge in these terms – not as a true or a false representation but through its practical effects, or lack of – underpins this research programme and seems central to it since its beginning.

Until now, the sociology of markets approaches the sociology of knowledge in distinctively pragmatist terms. But this is not all there is to their legacy of pragmatism. MacKenzie and colleagues (2007:14) next note that Callon (2007), whose main frame of reference is also Actor-Network Theory, “adds to the pragmatist tradition”. This is because Callon throws a distinctive focus on agencements: “Agencements are the assemblages or arrangements – which are simultaneously human and nonhuman, social and technical, textual and material – from which action springs.” (MacKenzie et al., 2007: 14-15). Hence, the actions that this research line studies do not stem merely from intentions and habits of human actors.

Instead, activities on the market are at the same time human as they are “nonhuman,” social, technical, material, and textual in their origins.

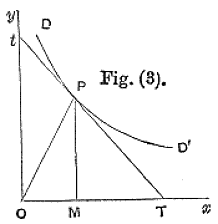

What follows is that financial formulas (e.g. Figure 2), material arrangements, models, statements, and any “nonhumans” in the most general sense have agency in economic markets, as elsewhere in society, and their effects should be explored rather than overlooked (Latour, 2005). But this is where the discussion encounters a problematic area and enters an often critiqued part of Actor-Network Theory.

With pragmatism’s key contention that we inhabit a material world, there may seem to be little or no ground for disagreement. Nevertheless, like many have argued, pragmatism as social theory is still about the concept of action – understood habitually or in other terms – where the main reference is to humans as actors (see Kilpinen, 2000). With this in mind, are other scholars simply speaking past classic pragmatists if they try to see activity in “nonhumans” such as technical devices, financial formulas, or economic statements as the credo of Actor-Network Theory goes?

Here, I find it useful to refer once again to Callon’s (2007) consideration of performativity, as he develops a fruitful attempt to clarify what he means by the concept, and its underpinning pragmatism, in so doing. Especially when speaking to the theme of pragmatic performativity, Callon has a particular problem in view. The general point for Callon (2007: 316) is that economic discourse is performative because “it contributes to the construction of the reality that it describes”. However, because this claim is counter-intuitive to many scientists whose self-understanding is that they describe and explain phenomena rather than construct them, there needs to be more exploration of what it means to say economics “contributes” to its objects in this context.

Drawing elements from Austin’s linguistics to semiotics and Actor-Network Theory, Callon’s (2007: 319) solution to this problem is to argue that performativity is a two-way street.

That which performs and that which is performed are co-dependent and neither is meaningful without the other. So, under Austin, performative statements critically depend upon the actions that they provoke, but vice versa, the actions also require the statements to be eligible. This is also why separations between material practices, linguistic practices, textual practices, bodily practices, and so forth cause friction against Austin’s original research programme – his contribution was to show that linguistic phenomena and pragmatic phenomena (or syntax, semantics, and pragmatics in linguistic terms) are rarely separate in the first place (Callon, 2007: 317).

This same interactivity of description and action also goes to the sociology of the markets. On the one hand, economics needs the economy to become performative, but on the other hand, the economy has no meaning without that same economics “that puts it into action” (Callon, 2007: 319) – in its concrete forms, including formulas, statements, and instruments. Hence when MacKenzie (2003) analyses the performativity of a new economic formula, he aptly characterises it as creating a world of its own. It follows that the formula includes vocabularies and instruments that constitute a world “without which the equation would not function and which would not function without the equation” (Callon, 2007: 320). This kind of dynamic is crucial to the human actors that operate on markets using the formula.

I believe one of the ideas behind performativity and the sociology of markets can now be summarised in another way. This basic argument in science studies (e.g. Barnes, 1983), is also more recognisable to pragmatist readers: knowing the economy is about interacting with the economy, to such an extent that knowing and doing economy are inseparable according to the sociology of markets. In Quest for Certainty, pragmatist philosopher John Dewey (1929) wanted to generate what seems like an even social theory that connects knowing and doing with each other. In so doing, he distanced himself from the old spectator theory of knowledge “according to which the things to be known is something which exists prior to and wholly apart from the act of knowing” (Dewey, 1929: 205). Instead of this, Dewey focused more on how “the act of observation, necessary in existential knowing, modifies that preexistent something”.

In a similar way, once we recognise that the sociology of markets follows from a sociology of knowledge, its connection to classic pragmatisms becomes more vivid and the notion that economic instruments have agency is qualified at the same time. The consequence is that economic instruments are performative insofar as they modify the world that they try to know – which did not exist, independently and wholly apart from being observed, prior to the act of trying to know it.

References

Abrams S & Lien ME (2011) Performing Nature at World’s Ends. Ethnos, 76, 3–18.

Austin JL (1962) How to Do Things with Words. Oxford: Clarendon Press.

Barnes, B (1982). Social Life as Bootstrapped Induction. Sociology 17, 524-545.

Callon M (1998) Introduction: The Embeddedness of Economic Markets in Economics. In: Callon M (ed.), Laws of the Markets. Oxford: Blackwell Publishers, 1-57.

Callon M (2007) What Does It Mean to Say That Economics Is Performative? In MacKenzie D, Muniesa F & Siu L (eds.), Do Economists Make Markets? On the Performativity of Economics. Princeton: Princeton University Press, 311-357.

Dewey J (1929) The Quest for Certainty. New York: Minton, Balch & Company. Available here

Faulkner A (2012) Law’s performativities: shaping the emergence of regenerative medicine through European Union legislation. Social Studies of Science, 42, 753-744.

Kilpinen, E (2000) The Enormous Fly-Wheel of Society: Pragmatism’s Habitual Conception of Action and Social Theory. Doctoral thesis, University of Helsinki, Department of Sociology. Helsinki: Department of Sociology Research Reports, No. 235.

Latour, B (1999) For David Bloor… and Beyond: A Reply to David Bloor’s “Anti-Latour”. Studies in the History and Philosophy of Science, 30, 113–130.

Latour, B (2005) Reassembling the Social: An Introduction to Actor-Network-Theory. Oxford, UK: Oxford University Press.

Latour, B (2007) Turning around Politics: A Note on Gerard de Vries’ Paper. Social Studies of Science, 37, 811–820.

MacKenzie D (2001) Physics and Finance: S-Terms and Modern Finance as a Topic for Science Studies. Science, Technology & Human Values, 26, 115-144.

MacKenzie D (2003) An Equation and its Worlds: Bricolage, Exemplars, Disunity and Performativity in Financial Economics. Social Studies of Science, 33, 831-868.

MacKenzie D (2007) Is Economics Performative? Option Theory and the Construction of Derivatives Markets. In MacKenzie D, Muniesa F & Siu L (eds.), Do Economists Make Markets? On the Performativity of Economics. Princeton: Princeton University Press, 54-86.

MacKenzie D, Muniesa F & Siu L (2007) Introduction. In MacKenzie D, Muniesa F & Siu L (eds.), Do Economists Make Markets? On the Performativity of Economics. Princeton: Princeton University Press, 1-19.

MacKenzie D & Spears T (2014) ‘A device for being able to book P&L’: The Organizational Embedding of the Gaussian Copula. Social Studies of Science, 44, 418-440.

Miettinen R (2006) Pragmatism and activity theory: Is Dewey’s philosophy a philosophy of cultural retooling? Outlines: Critical Practice Studies, 8, 3-19.

Miettinen R., Paavola S. & Pohjola P. (2012) From Habituality to Change: Contribution of Activity Theory and Pragmatism to Practice Theories. Journal for the Theory of Social Behaviour, 42, 345-360.

Miller D (2002) Turning Callon the Right Way Up. Economy and Society, 31, 218-233.

Rabinow, P (2008) Marking Time: On the Anthropology of the Contemporary. Princeton: Princeton University Press.

Schyfter P (2009) Entangled Ontologies: A Sociophilosophical Analysis of Technological Artefacts, Subjects, and Bodies. Doctoral thesis, University of Edinburgh, Science, Technology and Innovation Studies.

Shove E, Pantzar M & Watson M (2012) The Dynamics of Social Practice: Everyday Life and How It Changes. London: Sage Publications

Featured image by Alberto Carrasco-Casado (flickr, CC BY 2.0)