A few years ago, even an expert on the risks of subprime lending would have been astounded by the very suggestion: a global crisis triggered by poor people defaulting on their mortgages? In fact, the logics behind the chain reaction that left capitalism teetering on the brink of collapse between 2007 and 2009 continue to raise questions today. The attempt to answer them has prompted a renewed interest in financialization, a notion that underscores the ascendancy of finance in capital accumulation. The concept covers many features, but the crisis revealed its most prominent one: the extent to which the fates of global financial institutions and households have become intertwined. For low- and moderate-income populations, volatile financial markets have increasingly emerged as a means to securing their basic needs. For major banks across the world, capturing household revenue and trading it in international markets has become a vital profit strategy.

That finance capital builds on the indebtedness of ordinary people implies that it needs to permeate the structures of social reproduction.

Certainly, the CEO of an investment bank in the city of London does not know -even less care about- the lives and histories behind the securities he sells to various hedge funds. However, this does not change the fact that the financial products he works with are deeply embedded in very particular social relations and histories. Yes, financial markets have an inbred capacity for abstraction: they codify complex social relations into equities and bonds, attaching figures to them. But no technology can turn human needs and values into mere financial products, “melting all that is solid into air”.

It is not by chance that Marx started his greatest work with the assertion that the market value of a commodity does not do away with its many other values.

Taking into account this elementary fact, it is striking that the actual people targeted by financial programs have remained relatively absent from the literature on financialization and its crises. Scholarly thinking has for the most part focused on policy, statistical data, and discourse. These perspectives are all crucial to understanding current patterns of accumulation, but they become problematic when households are presented as passive recipients that simply replicate the narratives of financial products and schemes.

Changes in the forms of accumulation are not merely imposed top-down: they are also produced through the relations that structure people’s everyday life.

Such a gaping hole calls for an anthropology of actually existing financialization. By this I mean the study of the institutional transformations, social relations and dispositions that underlie the growing dominance of finance capital. Such an endeavor can only be accomplished through an exploration of all scales involved: from the state and financial markets to the household and its social milieus (the living sphere, the workplace). In short, the structures, practices and meanings which make the financialization of social reproduction possible. The remainder of the text builds on the arguments above and outlines four central dimensions of this approach, drawing from research on the bubble-and-bust as it unfolded in Spain.

1. Finance penetrates the household by mediating systems of private provision where public provision (for housing, pensions, health, education, etc.) is curtailed or dismantled. Substantial state intervention is necessary to create the conditions for capital accumulation in these spheres of social reproduction and their integration with financial markets.

Housing in particular plays a key role in the financialization of home: mortgage debt is the largest component of household indebtedness in the world.The significance that housing can acquire for financial accumulation is perhaps nowhere as clear as in Spain. Today, the vast majority of the population in that country (around 87 percent) own their home. To be more precise, what many people own is a mortgage that they will most likely be repaying for as long as they live. In 2007, at the peak of the boom, residential mortgage debt to GDP ratio reached the staggering figure of 62 percent. Yet a brief glance at history and… surprise: only 50 years ago most Spaniards lived in rented dwellings. How did this huge transformation come about?

The seeds of the shift were planted during late Francoism, in the 1960s. The technocrats of the regime had always envisaged industrial production as the engine that would modernize the national economy. But they soon realized that other sectors would need to be developed to compensate for the country’s competitive disadvantages vis-à-vis the advanced industrial economies of the European north. The solution came through what David Harvey calls the secondary circuit of accumulation, i.e. switching investment flows to the built environment. The dictatorship earnestly created the conditions for capital accumulation around real estate and construction, shaping both supply and demand. First, by giving birth to a powerful industry, capitalized by a series of developers that would later acquire an oligarchic position. Second, by promoting large-scale housing for sale to the working classes, under a system of public mortgages and price controls. This was one of the most singular legacies of the Francoist regime, honored until today by social-democratic and conservative governments alike: state-subsidized apartments that can be privately owned and eventually traded in the market at any price. The ultimate expression of this pattern of accumulation is the plethora of residential beehives that were built in the country’s urban peripheries during the housing boom lasting until 1973.

Whereas French grands ensembles, US projects, or English new towns featured social rented units, most polígonos de viviendas in Spain were inhabited by petty owners, and prone to speculative strategies.

In the 1980s and 1990s, Spanish industries were severely restructured and capital accumulation increasingly specialized in the attraction of international financial flows through real estate and construction. In this context, the continued extension of mortgages to low- and moderate-income populations gained an even bigger significance. First, financial markets were highly deregulated, public banking abolished and private financial transactions given free reign. The foreign investment manias in Spanish real estate and financial markets of 1986-1991 and 1997-2007 could have never taken place without these shifts. Second, changes in the mortgage and securities markets allowed commercial banks to grant loans extending both their length and the maximum legal loan-to-value percentage, and to turn them into marketable securities. Since 1998 and throughout a decade, mortgage securitization boomed and became the means to finance a large portion of bank lending in the country. The reconstruction of mortgage and securities markets allowed boosting land values by extending loans to the low-income strata of the working class, particularly the young generations and the immigrant, without necessarily raising their precarious wages. Finally, the absolute deregulation of the real estate market made it possible to build in virtually every single plot of land.

These vast regulatory transformations crystallized in the boom-and-bust of 1997-2008. Real estate assets experienced an unprecedented revaluation together with mortgage prices, which allowed financial institutions to appropriate an ever-higher portion of household savings. At the same time, private consumption took off: not due to nominal growth in employment rates and wages (which stagnated) but to the wealth effect generated by the revalorization of real estate assets in the hands of households (acting as collateral for growing levels of household debt).

2. The privatization and financialization of social reproduction are embedded in projects of class domination, historically shaped and permeated with contradictions.

When Francoism extended home ownership and loans to the working classes, it accomplished an old bourgeois dream. Since the early 19th century, the European ruling classes had been worried about the growth of urban-based proletariats, les classes dangereuses that inhabited the always-ungovernable slums. In many different countries, home ownership appeared as a way of tying the better-off fractions of the working class to the dominant social order: giving them a stake in society while maintaining the property and class privileges of the powerful. Mortgage payments were expected to instill in workers the discipline of thrift and calculation, which would allegedly inhibit the growth of collectivism (what some called “the barracks of socialism”) while strengthening self-sufficiency and family life in the image of the dominant classes. The Spanish dictatorship took this ambition a step further, to encompass a wider social majority: in 1957, the Head of the Housing Department announced the government’s aim build “a country of homeowners, not proletarians”.

Francoist technocrats imagined a society of petty owners, with low levels of redistribution, where oligarchic interests would never be endangered.

Their program was infused with a paternalist spirit, informed by the social doctrine of the church: owning the home was described as “a moral condition for the family”, the antidote to “the tragedy of communitarian life”, and a disciplining tool: “man, when he doesn’t have a home, takes over the street, becomes ill-tempered, subversive and violent”.

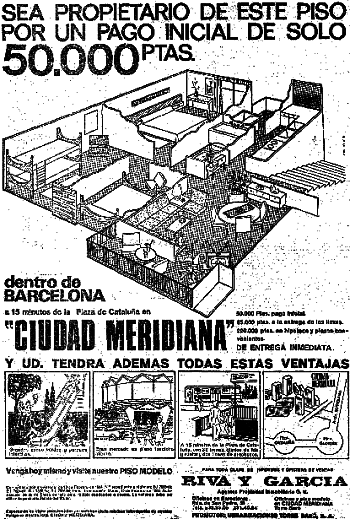

However, projects of class domination tend to contain contradictory views. Whereas paternalist conservatism saw home ownership as a pre-condition for the intellectual and moral elevation of the masses, emerging laissez-faire notions sought to turn all individuals into capitalists. Such an ideological difference incarnated, after all, a fundamental contradiction inherent to the commodification of housing: the introduction of exchange value (a real estate asset tied to the fluctuations of the market) into the sphere of the “home” (linked to a household, with all sorts of moral and affective values attached to it). Take the publicity deployed in the late 1960s to advertise Ciutat Meridiana, the peripheral area in Barcelona where I lived and did research (2007-2010):

“Buy today, now that you can choose, and be assured to make a generous profit in the near future”.

In their campaigns to the proletariat, developers and real estate companies underscored the idea of the home as a financial investment, prefiguring the popular capitalism that would become hegemonic in the decades to come.

Today, Ciutat Meridiana figures among the poorest neighborhoods in Barcelona, but at the same time boasts the highest percentage of homeownership and household debt. It epitomizes the central role that the purchase of an apartment has come to play in the reproductive strategies of the working classes. Gradually, the vast majority of citizens, including the poorest, have subscribed the logic of the home as a source of thrift and an investment: a pool where household revenue can be stored and generate profit if land prices go up. During booming cycles, the revaluation of homes work as collateral for mortgages that can sustain the consumption of many other goods, such as furniture or cars. However, these loans have increasingly adopted a predatory nature, as they are linked to a series of mechanisms (such as extremely volatile interest rates) that allow financial institutions to expropriate from households up to two or three times the original price of the home.

3. Financialization hinges on the structures of inequality that shape the household and its social milieus. Financial flows travel through these social relations, ultimately to the benefit of banks.

The expansion of finance capital between 1997 and 2007 absorbed cast-off areas like Ciutat Meridiana into the field of real estate speculation. The boom in the housing market of the neighborhood implied a price increase proportional to other central and gentrifying areas of Barcelona. The key in this process was the extension of mortgages to the most precarious strata of the working classes. Impoverished migrants, in particular, were key as they prolonged the growth of the financial-real estate industry: both as low-paid workers in the construction sector and as consumers of mortgage loans. This new demand was channeled towards impoverished neighborhoods where the most affordable housing was concentrated. Thus, unknown and slightly stigmatized neighborhoods were introduced onto the maps of potential buyers. Between 2002 and 2007, Ciutat Meridiana saw the opening of 7 new real estate offices.

Some of the agents who focused on attracting and channeling these impoverished migrants to Ciutat Meridiana described themselves as ‘specializing in immigration’.

The spectacular growth of this ‘migrant demand’ contributed to spectacularly boosting property values, which created a general feeling of opportunity for social mobility in a place like Ciutat Meridiana. Many old residents, second-generation migrants, turned their apartment into what people routinely called a ‘bridge-flat’: a primary dwelling used as a financial guarantee, often prior to being actually sold, in order to get a mortgage and buy a new home of higher economic value. This allowed many of these old-timers to move to suburban locations often considered more attractive. In less than a decade, half of the neighborhood’s population was replaced by a new wave of residents, mostly foreigners. Eventually, the general feeling of a ‘gold rush’ turned some homes into financial assets, almost devoid of use-value: their latent nature as an investment and a potential source of profit – so clearly expressed in the publicity of the 1960s – was now massively realized.

The point is that financialization, like any other form of capital accumulation, depends on the production of difference. There is no doubt that predatory lending hit across different strata of the Spanish working classes. However, the case in Ciutat Meridiana shows that this process was uneven, as it was predicated on a clear division between new immigrants with no assets and older Spanish residents with some asset (basically their revaluated homes). Generally, the vast majority of migrants accessed the housing and mortgage markets in a clearly disadvantaged position, during the period when prices were peaking. They were generally given mortgages of a clear predatory nature, characterized by extremely volatile interest rates. Yet they formed a demand that contributed to boosting prices in peripheral areas, which the better-off residents could capitalize on. Moreover, the new residents were substantially impoverished due to the type of mortgages they signed, which contributed to intensifying the socioeconomic polarization between them and long-term residents.

If inequality at the neighborhood scale was crucial for financialization, the same occurred with the household. The extension of mortgages to the poorest populations depended on the networks of relations that the new homeowners built around them, and their internal differences. Since household income was often below the price of mortgage, the vast majority of new homeowners chose to sublet rooms. This was possible due to the existence of a huge number of migrants who needed to find accommodation, usually undocumented, and who were therefore legally unsuitable for a mortgage.

As a consequence, the more established migrants emerged both as homeowners and landlords with the capacity to provide shelter for the undocumented ones, who then became their tenants.

Thus, the homeownership and mortgage markets were embedded in the informal subletting market: a structure by which the payment of the legally regulated debt that homeowners contract with banks depends on the payment of the morally regulated debt that they create with their relatives, friends or flat mates.

4. The narratives inherent to financial products and schemes (such as risk and commodification) are not merely replicated in the sphere of the household but entangled with other meanings and values.

The extension of financialization across the social spectrum has led researchers to focus on the narratives produced by financial institutions and their performative effects on the lives of ordinary people. Some have decried that people with no capital are increasingly led to think like investors or capitalists, taking risks that were hitherto the province of professionals. Others have indicated that one of the purposes of neoliberalism is to intensify commodification in all realms of social life. These analyses reveal the ideological project behind financialization, and sometimes lead to the commonplace affirmation that ordinary citizens in Main Street think the same way people do in Wall Street. However, what complicates the equation is that no family has yet been found that projects itself as a mere financial firm. If anything, ethnographic research proves that people’s practices are embedded in complex context-bound meanings.

First, financialization is highly dependent on the commodification of the living space. However, people tend to deal with abstract market logics through concrete interpersonal relations that are often framed by moral and affective values. In Ciutat Meridiana, payments among homeowners and tenants, eventually absorbed by credit institutions, were often seen in the sphere of household reproduction as acts of higher or lower solidarity, integrated in a language of favors, and enmeshed with other forms of support. At the scale of the poor household, the structural inequalities generated by financial expropriation are often lived and experienced through the moral obligations and the constraints of constantly changing moral economies.

The home can thus be a moral container of structural class inequalities and a productive base for exploitative and rent-seeking activities.

Second, perceptions of risk are not structurally inherent to financialization, but contingent on market conjunctures. During the Spanish boom-and-bust, the vast majority of people I met, some of whom were repaying several mortgages, did not perceive themselves as risk-takers. To the contrary, real estate assets were seen as absolutely secure wealth deposits, and mortgages as sound pathways. In 2007, I was often treated as “dumb” for renting my apartment in Ciutat Meridiana and “throwing my money away” instead of getting a mortgage. In a context of incessant real estate revaluation, investing one’s money in a home had been socially constructed as a rational option, devoid of any risk. It was only when the financial crisis began that some people (especially those that had been hard-hit) began speaking of the risks they had taken when they signed for a mortgage.

In other words, evaluations of risk or security are often attached to the basic good or service in question and not to the financial asset or liability that mediates it. This implies that there are many other meanings at play. In Spain, despite the financial domination entailed, poor people often endowed home ownership with very different qualities: a property that can be transmitted across generations, a safe place during old age to compensate for the lack of public nursing homes, etc. Sometimes people took a quasi-Lockean stance and linked ownership to the notion of “freedom”, though with class connotations. I will never forget the story of a man whose father had escaped in 1970 from conditions of quasi-servitude in an Andalusian large estate to Ciutat Meridiana. According to the man, when his father bought their first apartment, he joyfully exclaimed: “My children: if you want to take a dump in this home, you can do it wherever you like, cause here no señorito will come and tell me to keep my kids from bothering him. If you want to pee in the middle of the living room, go ahead and do it!”

Paradoxically, the home-as-property emerged as the only kingdom where the subaltern felt they could reign.

Photo credits:

Header: Photo by Michael Galpert (flickr, CC BY 2.0)

Text: All photos are courtesy of Jaime Palomera.