If, like us, you find yourself lost in translation each time you are confronted with the world of finance, why not start educating yourself with…a novel? Yes, a novel! And to kill two birds with one stone, you’ll become a nicer person as a recent scientific study published in Science journal asserts that reading literary fiction can greatly improve our emotional intelligence.

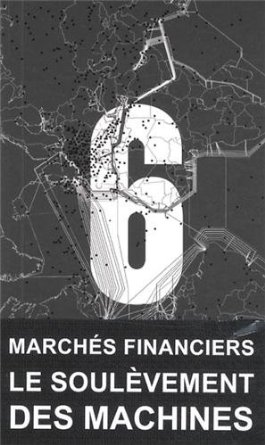

Well, you may develop cynicism instead of empathy after reading this disconcerting piece enigmatically entitled 6, deprived of author’s name and published by Brussels based editor Zones Sensibles. Sadly, the book is currently only available in French…but considering its success (40,000 copies sold in 6 months), we can expect an English translation soon.

In common representations, finance refers to greedy traders, the power of Goldman Sachs, a capitalism that has lost touch with the real economy and is locked in frantic and dangerous speculation. Yes. Certainly. Except it’s not. And not only that. And maybe not even that at all. 6 puts aside such stereotypes to give us a totally different vision.

And if Wall Street was not on Wall Street, but on 1700 Mac Arthur Boulevard, Mahwah (New Jersey), in a huge air-conditioned warehouse consuming as much energy as a city of 10 000? And if the real masters of the Stock Exchange were not traders but unscrupulous algorithms acting at the speed of lightning? And if, through the manipulation of money, machines were taking power over humans? And if, in fact, what was going on was the “Rise of the Machines”, as indicated in the book’s subtitle?

At this point, the reader wonders if she is reading SciFi. Except that operations realised automatically by computers on the stock exchange has become a reality.

But the system has become uncontrollable. Not only is it totally disconned from the real economy, but it is constantly on the verge of collapsing. This prospect worries the creators of algorithms themselves, these Frankenstein of modern times: one of them, Thomas Peterffy, heckled the Annual Congress of the World Federation of Exchanges in October 2010, declaring : “In the last twenty years came computers, electronic communications, electronic exchanges, dark pools, flash orders, multiple exchanges, alternative trading venues, direct access brokers, OTC derivatives, high-frequency traders … Reg NMS in the U.S. — and what we have today is a complete mess.”

The disaster is near – if not already there. But by then, we will have the pleasure of reading this excellent book. And reflect on the very timely theme that runs through it, reminding us of a Latourian motif: is it only in the financial world that machines outweigh humans? Have we produced ‘things’ that we are no more able to control?

AND- if you feel this read did not fully satisfy your thirst for deeper understanding of the financial world, here are slightly more serious references:

Riles, Annelise. 2011. Collateral Knowledge: Legal Reasoning in the Global Financial Markets. Chicago. University of Chicago Press.

Ho, Karen. 2009. Liquidated: An Ethnography of Wall Street. Duke University Press.

Graeber, David. 2012. Debt: the First 5,000 Years. New York. Melville House.

Keith Hart & Horacio Ortiz. 2008. Anthropology in the Financial Crisis. Anthropology Today. Volume 25, issue 6.

Gudeman, Stephen. 2008. Watching Wall street : A Global Earthquake. Anthropology Today. Volume 25, issue 6.

Anthropologists engaging with finance : a discussion in Cultural Anthropology Online. Fieldsights – Theorizing the Contemporary. May 2012

FILMS

An interview of Graeber on Democracy Now on the global debt crisis and the Occupy movement.

Inside Job – The award winning documentary ‘Inside Job’ [2011 | US] by Charles Ferguson is the most insightful and illuminating amongst a number of such attempts that deal with the global financial crisis, which is wrecking lives and economies across the world to this day. Watch here